How Contractors Can Use Financing to Win Bigger Home Improvement Projects

Key Takeaways As home improvement projects grow more complex, and let’s be honest, more expensive, contractors need smarter ways to help homeowners move forward with bigger ideas. While financing has long been used to increase sales, experienced contractors are now leveraging it as a strategic sales tool to win premium, high-value projects they might otherwise […]

Key Takeaways

- Financing helps contractors win larger, high-ticket home improvement projects

- Monthly payment options make luxury upgrades more approachable for homeowners

- Financing is a powerful sales tool for multi-room, custom, and premium projects

- Multiple payment plans reduce objections and speed up approvals

- Contractors who offer financing are better positioned to compete for upscale jobs

- Financing builds trust and credibility with high-income homeowners

As home improvement projects grow more complex, and let’s be honest, more expensive, contractors need smarter ways to help homeowners move forward with bigger ideas. While financing has long been used to increase sales, experienced contractors are now leveraging it as a strategic sales tool to win premium, high-value projects they might otherwise lose.

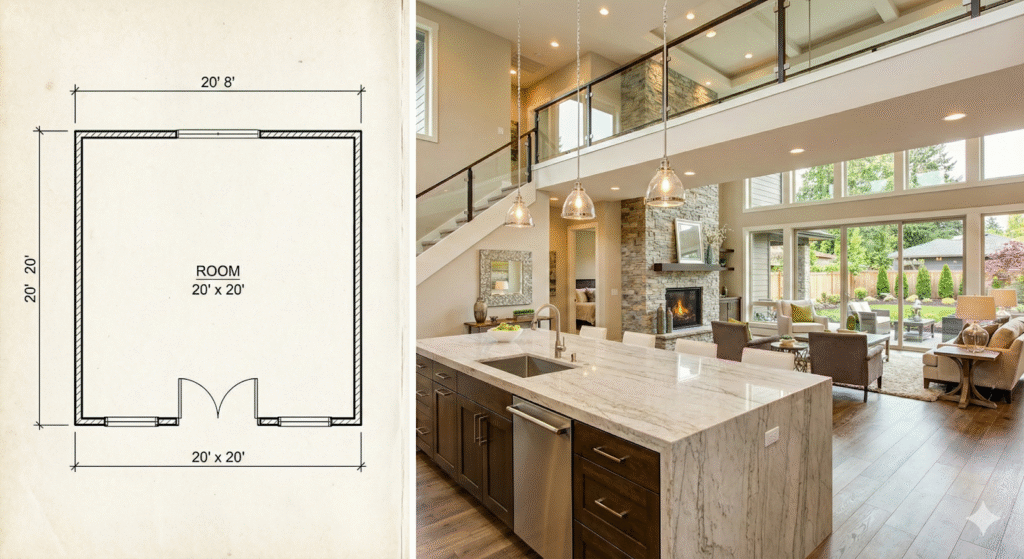

From luxury remodels and multi-room renovations to smart home automation and outdoor living spaces, financing allows contractors to position larger projects as achievable, flexible, and aligned with modern homeowner expectations.

Here’s how contractors can use financing to consistently close bigger, more profitable home improvement projects.

1. Use Financing to Remove the Upfront Barrier to Luxury Projects

High-ticket projects rarely fail because homeowners don’t want them; they fail because writing a large check feels risky, even for affluent buyers. Contractors who offer financing eliminate that hesitation early.

By spreading costs over time, financing allows homeowners to:

- Commit to premium projects without draining savings

- Preserve cash for investments or emergencies

- Move forward with the full scope instead of cutting corners

For contractors, this means fewer downsized proposals and more approvals on luxury remodels that would otherwise stall.

2. Win Bigger Jobs by Leading with Monthly Payments, Not Total Cost

Contractors close larger projects when they change how pricing is presented. Financing allows you to lead with predictable monthly payments instead of overwhelming total costs.

This strategy is especially effective for:

- Smart home automation and integrated systems

- Energy-efficient HVAC and electrical upgrades

- Custom kitchens, bathrooms, and whole-home remodels

When homeowners see how premium upgrades fit comfortably into a monthly budget, they’re more likely to approve larger scopes and higher-end options.

3. Turn Single-Room Projects into Multi-Room Renovations

Financing gives contractors the opportunity to expand project scope during the sales conversation. Instead of homeowners tackling renovations one space at a time, financing allows them to combine projects into a single, well-planned renovation.

Contractors who present bundled options benefit from:

- Larger contract values

- More efficient scheduling and labor planning

- Increased lifetime customer value

By clearly showing how each additional room impacts the monthly payment, contractors can upsell naturally, without pressure or pushback.

4. Package Premium Projects to Simplify the Buying Decision

For high-end work, complexity can slow homeowner approvals. Financing makes it easier to sell premium project packages by turning multiple upgrades into one clear, affordable solution.

Common high-value packages include:

- Outdoor living spaces with kitchens, lighting, and heating

- Finished basements with media or entertainment features

- Whole-home energy efficiency improvements

- Custom garages or home offices

When bundled projects are paired with financing, homeowners are more likely to choose comprehensive solutions instead of piecing upgrades together over time.

5. Use Financing to Overcome Budget Objections on Large Projects

Big-ticket proposals almost always come with hesitation. Financing gives contractors a practical, non-confrontational way to move past common objections like:

- “That’s more than we planned to spend.”

- “We need time to think about it.”

- “We don’t want to tie up that much cash.”

Instead of pushing harder, contractors can shift the conversation to flexible payment options, helping homeowners see the feasibility instead of the risk.

6. Position Financing as a Strategic Option for High-End Buyers

Luxury homeowners don’t view financing as a last resort, but as a smart financial tool when it’s presented correctly.

Successful contractors position financing as:

- A way to preserve capital

- A flexible planning option

- A professional, modern service offering

This approach builds credibility, reinforces trust, and aligns with the expectations of high-income buyers who value control and convenience.

7. Introduce Financing Early to Avoid Limiting Project Scope

Waiting until the end of a consultation to discuss financing can unintentionally cap how big a project becomes. Contractors who want to win larger jobs introduce financing from the start.

Best practices include:

- Mentioning financing during the initial consultation

- Showing payment terms and ranges alongside design or upgrade options

- Using side-by-side payment comparisons to guide decisions

When financing is part of the conversation early, homeowners are more open to premium upgrades and expanded scopes.eowners are more open to premium upgrades and expanded scopes.

8. Capitalize on Market Demand for High-Value Home Improvements

Homeowners are increasingly investing in their spaces, driven by:

- More time spent at home

- Growing interest in energy efficiency

- Demand for smart home technology

- Desire for customized, high-end living spaces

Contractors who pair these trends with flexible financing are better positioned to compete for (and win) larger, more profitable projects.

9. Close Large Projects Faster with Financing-Driven Approvals

Large projects often stall during the funding phase. Financing removes that bottleneck and helps contractors secure approvals faster.

Faster financing decisions lead to:

- Quicker project starts

- Stronger sales momentum

- Fewer lost opportunities to competitors

When speed matters, financing becomes a critical tool for winning complex or custom jobs.

Why Financing Is Essential for Contractors Scaling Up

Contractors who want to move into higher-value project categories need financing as part of their growth strategy. Without it, they risk losing premium jobs to competitors who make larger projects easier to approve.

Financing helps contractors:

- Compete for upscale clients

- Increase average project size

- Improve close rates on complex jobs

- Scale revenue without scaling lead volume

Financing Tools Built for Bigger, More Profitable Projects

Winning larger home improvement projects requires financing solutions that support complex sales, premium upgrades, and higher dollar amounts. Sunlight Financial equips contractors with multiple financing options so you can align payment solutions with each homeowner’s budget, project scope, and buying mindset without disrupting your sales flow.

Sunlight Maxx™: Expand Buying Power Without Limiting Approvals

Sunlight Maxx® is Sunlight’s proprietary Prime Plus Lending strategy designed to help contractors approve more homeowners across a broad credit spectrum through a single, streamlined experience. Instead of sending customers through multiple lenders, Sunlight Maxx® increases purchasing power while keeping the approval process simple.

For contractors targeting larger projects, this means fewer stalled deals, more comprehensive scopes of work, and the ability to confidently present higher-value proposals without worrying about financing limitations.

Orange®: Close Complex Deals Faster with Full Sales Visibility

Orange® is built for sales teams handling high-value, multi-stage projects. It allows contractors to present financing options seamlessly during consultations with soft credit checks, side-by-side payment views, and fully digital applications.

With built-in reporting and Flex Approvals™, Orange® supports real-world sales scenarios, like mid-project upgrades or design changes, without requiring new contracts or restarting the credit decision process. This keeps projects moving forward while maximizing revenue opportunities.

Tangerine™: Simple, Mobile Financing for Fast-Paced Sales

Tangerine™ is a streamlined, mobile-first financing solution ideal for contractors who want speed and simplicity. With no dealer fees, multiple loan options, and funding that can occur as quickly as 24 hours, Tangerine™ makes it easy to offer financing during in-home consultations or on the job site.

QR code applications allow homeowners to apply instantly, helping contractors secure approvals and move forward before hesitation sets in, especially valuable for competitive or time-sensitive projects.

Choose the Right Financing Strategy for Every Project

Each Sunlight solution is designed to help contractors improve close rates, increase project size, and reduce delays, no matter the type or scale of work. Comparing options allows you to build a financing strategy that supports your sales process today while positioning your business for higher-value projects tomorrow.

Turn Financing Into a Competitive Growth Advantage

Partnering with Sunlight Financial gives contractors the technology, flexibility, and support needed to win bigger projects with confidence. Our financing platforms integrate seamlessly into your workflow, and our dedicated training and account support ensure your team is prepared to sell effectively from day one, so you can focus on growing revenue, not managing friction.

Frequently Asked Questions

How does financing help contractors win bigger projects?

Financing makes large, premium projects more affordable by spreading costs over time, allowing homeowners to approve larger scopes of work.

Is financing only useful for homeowners who can’t pay upfront?

No. Many high-income homeowners use financing to preserve cash, manage budgets, and invest in higher-quality upgrades.

When should financing be introduced during a sales consultation?

Financing should be discussed early to prevent budget limitations from shaping the project scope too soon.

What types of projects benefit most from financing?

Luxury remodels, multi-room renovations, energy-efficient upgrades, smart home systems, and outdoor living projects all see higher homeowner sales with financing.

Does offering financing slow down large project approvals?

No. Financing often speeds up homeowner decisions by eliminating the need for homeowners to secure outside funding.